When you are just starting in the food business industry, it can be hard to keep track of all expenses. But once you miss a payment or forget about an expense, you open yourself to errors that can eat into your profit.

That’s why it is important to have a restaurant monthly expenses list that you can check at the end of each period to ensure all costs are accounted for and to find ways to spend less.

Restaurant Monthly Expenses List

Use this list as inspiration to calculate your restaurant’s monthly expenses and follow our tips to increase your profit:

1. Food costs

The average restaurant monthly expenses for food are about 28-35% of your revenue. You can use this formula to calculate your food cost percentage:

Restaurant food costs percentage = ((Beginning Inventory + Purchases) – Ending Inventory) / Total food sales

The food expenses for a restaurant are probably the most variable out of all costs because a lot of factors can influence them such as the number of clients, food waste, or ingredient price.

Read more: Restaurant Food Costs: How to Manage the Rising Inflation without Losing Customers

Here are a few tips that will help you reduce food costs every month:

- Have a small menu: this will help you limit the number of ingredients you buy and reduce food waste. It also has the added benefit that it builds trust with your customers because they will know you prize quality over quantity;

- Properly label and store your items: create restaurant standard operating procedures that will help your employees manage ingredients more efficiently. Every container should be labeled with an expiration date and the ingredients that expire faster should be at the front so they can be used first;

- Reduce portion sizes: if your clients always leave food on their plates, the portion is clearly too big. If you make the portion size smaller, you will be making a bigger profit, while still satisfying customers;

- Use seasonal ingredients: ingredients that are in season will always be cheaper, so you will lower your food expenses. Clients will also be pleasantly surprised to discover a new menu. If you use our menu creator, you can make limitless changes to your menu, all for free.

2. Labor expenses

The average labor expenses can vary from 25% to 45% of your total operating costs. The lower end is descriptive of fast-food places and the higher end of fine dining ones. You can use this formula to determine the percentage:

Labor Cost Percentage = Labor Cost / Total Operating Cost = Result x 100

Here are a few tips to lower restaurant monthly expenses related to labor:

- Rely on technology: install technology that can replace some of your employee’s duties. For example, instead of having employees answer the phone and run notes with orders to the kitchen, use an in-house online ordering system with a kitchen display system;

- Increase employee satisfaction: it is more expensive to replace an employee because you must invest in finding and training a new one. Instead, take measures to increase retention such as offering benefits, fair scheduling, and maintaining an open line of communication;

- Minimize overtime: use technology for efficient restaurant employee scheduling to reduce overtime as it is expensive;

Read more: 5 Tips on Efficient Management of Restaurant Labor Costs

3. Technology expenses

These days, technology is a must-have for any restaurant that wants to make their processes more efficient and their clients happier. Gone are the days of long waits and multiple errors because technology makes your employees’ jobs easier.

The technology expenses will depend on what you have purchased for your restaurant. The most common costs are for:

- Point of sales system

- Kitchen display system

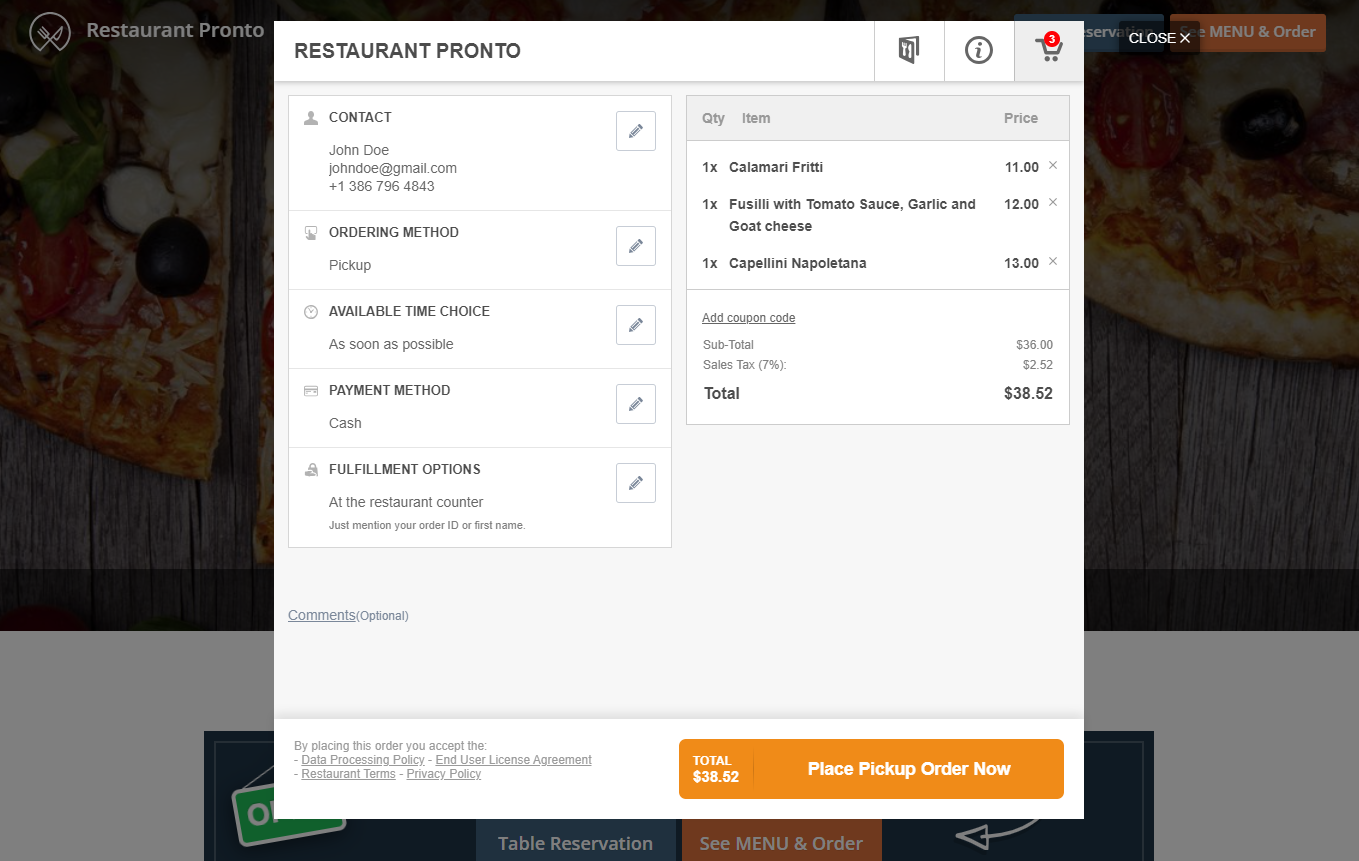

- Online ordering system

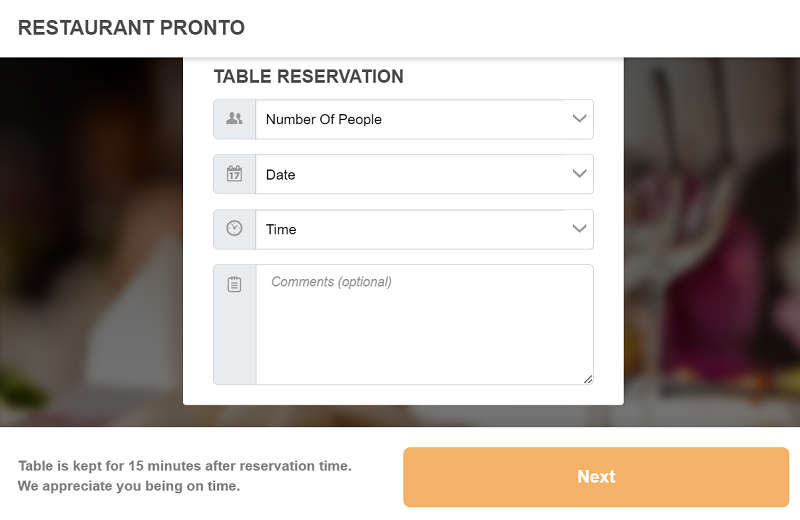

- Table reservation system

- Third-party ordering apps

- Inventory management system

- Employee management system

- Website

Here are a few tips for lowering restaurant monthly expenses related to technology:

- Let go of third-party apps: you have to pay a large commission for your restaurant to be listed at the bottom where not many customers will find it. Instead, use the free online ordering system from GloriaFood to streamline your ordering process while allowing customers to order directly from your website, social media, or native app;

- Get a sales-optimized website for which you only pay once: no need to worry every month if you paid for your restaurant’s website and worry if clients can find you online. With GloriaFood, you can generate a sales and SEO-optimized restaurant website in just 10 minutes. It will also cost you less than a pizza;

- Use a free table reservation system: if you use the online ordering system from GloriaFood, you just need to take a few extra steps to add the widget for table booking on your website.

4. Marketing expenses

The average restaurant monthly expenses budget regarding marketing is usually 3-6% of your total sales. The exact value depends on the marketing strategies and tools you use and how much you pay for them.

Read more: How to Create a Marketing Budget Plan for Restaurant Success in 4 Easy Steps

Here are a few tips to help you lower your marketing expenses:

- Optimize your Google Business Profile: it doesn’t cost you anything to claim your Google Business Profile. If you add all the required info such as a link to the menu, exact address, working hours, and lots of photos, you increase your chances of ranking high in Google searches.

- Be more active on social media: paid ads on social media can bring you more clients, but so can regular posting, it just takes a bit more effort. Because you don’t have a big following at the start, organize share-the-post contests to reach a bigger audience. Furthermore, respond to every comment and message and use conversion-centric captions;

- Use GloriaFood to set up restaurant promotions: you can add a promotion for free at the top of your restaurant menu. If you want to add more simultaneously, you will have to pay a small price that is worth it when you notice the increased number of orders;

5. Takeout material costs

Because people expect to be able to order online, restaurants are now faced with a usually ignored cost: takeout materials expenses. All the containers, packaging, and single-use cutlery add up to quite a sum that must be part of your restaurant’s monthly expenses.

Check out these tips to pay less for takeout materials:

- Let go of plastic: because of the widespread concern about global warming, eco-friendly restaurant packaging will surely become the norm. The taxes are now bigger for plastic containers so it is cheaper to be more friendly to the environment;

- Use portions that perfectly fit your containers: if you only fill up half a container with food, you just waste money on half of the material. When you order your packaging, consider the size of your food portions.

6. Equipment expenses

The equipment in your kitchen must withstand industrial use and that can often lead to breakage. You never know when one of your most important pieces such as the mixer will die and you will have to immediately replace it to ensure you can finish the orders.

If you don’t want to take a big hit when an equipment failure occurs, you should have a monthly budget to account for it.

Here are a few tips to ensure you won’t include new equipment in your restaurant’s monthly expenses:

- Maintain your equipment: if you regularly service your equipment, it will last longer. This can mean anything from regularly cleaning it to oiling the moving parts;

- Buy top-of-the-line equipment: do your research before purchasing anything and read reviews, so you pick equipment that others have tested and has proven to withstand the test of time.

7. Rent costs

If you own the property, you won’t have to worry about paying rent monthly, but you will still have to account for property taxes and permits. Maybe set an alarm for a few days before your payment due date so you never miss a payment.

The rent is usually one of the fixed restaurant monthly expenses, as you already have a signed contract for it. All you can do to lower it is to try to negotiate with your landlord for a lower sum if you extend your renting period.

8. Utility expenses

Utilities are categorized as semi-variable restaurant monthly expenses as you start from a minimum fixed sum, but they can go up depending on how much you use (water, electricity, gas).

If you want to lower your utility bills, do the following:

- Use LED for all your lights: if you replace all your old lights with LED-powered ones, you will see a decrease in your electricity bills because they use less electricity to produce the same amount of light;

- Use smart and energy-efficient appliances: energy efficiency will significantly lower your electricity bill. On top of it, if you can control most of your appliances and lights from your phone, you can turn them off from afar, so they don’t use up resources when not in use;

- Train your employees: you can teach your staff to turn lights and water off when they are not using them to prevent the utility bills from going up.

9. Maintenance costs

This is one of the variable restaurant monthly expenses as you never know what you will have to replace each time. Maybe this month a lot of the tablecloths got too dirty to wash, and the next one a lot of the glasses got broken.

Set aside a monthly budget for maintenance that will cover all these unexpected charges. Because these costs can’t be foreseen, there is no way to lower them, all you can do is budget for any situation.

Final Words

Being able to keep track of all expenses, especially your restaurant’s monthly expenses, will help you create an accurate budget and keep you accountable for paying every bill on time. Furthermore, if you heed our advice, you can also find new ways to lower costs and increase profit.